tax loss harvesting wash sale

This works by selling an investment at a loss with the intention to repurchase it at a later date outside of the IRS 30-day wash sale rule window. Capital losses can offset capital gains or can give you a capital loss which you can report on your tax return.

What Is Tax Loss Harvesting Smarter Investing

Tax Loss Harvesting the Wash Sale Rule.

. To claim a loss for tax purposes. However when a position has a. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting.

Assuming that I had no other capital gains or losses for the year I could use my loss to offset my entire gain from Security. Generally a washed loss is postponed until the replacement is sold but if the replacement is purchased in an IRA401 k account the loss is permanently disallowed. To avoid the wash sale rules while still harvesting the gains you could just wait the 30 days to buy the security back.

Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for. 800 767-8040 Free Consultations Nationwide. Your losses dont just offset your gains.

It applies to most of the investments you could hold in a typical brokerage account or IRA including stocks bonds mutual funds exchange-traded funds ETFs and options. Tax loss harvesting overview. Wash sale rule applies when an asset that is substantially identical to the first one has been sold at a loss before being bought back within 30 days.

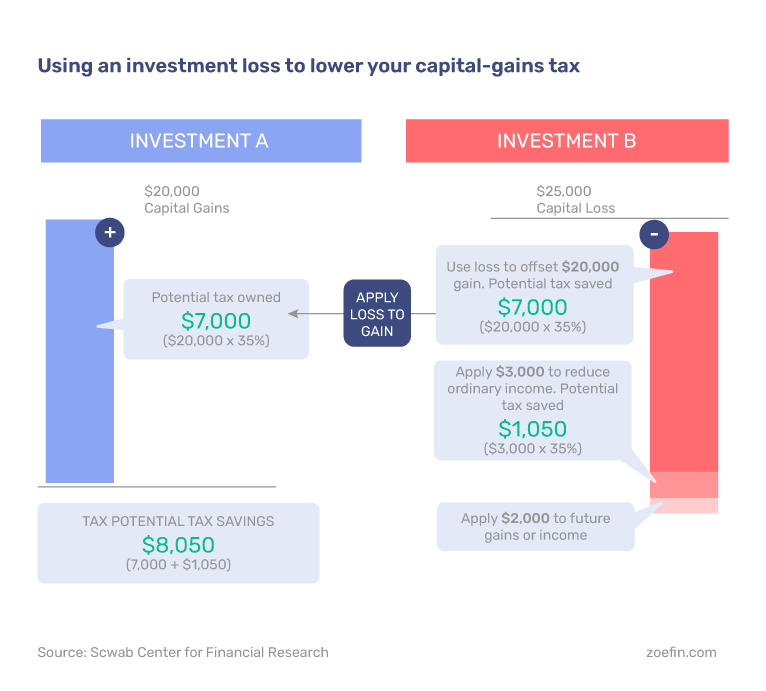

The Dry-Cleaned Wash Sale. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. Up to 3000 of losses each year can be taken as a deduction.

The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim artificial losses in. The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss and immediately buying it back again which could otherwise result in tax savings in the form of a deductible loss without the investor substantively changing hisher economic position at the. As most of you know gains on stocks are taxable but any losses reduce the net gain sometimes to even zero or less.

If not managed correctly wash sales can undermine tax loss harvesting. Sold - 97 Harvest Ln Commack NY - 515000. This can save a lot of tax.

Details a specific time period and action when it is against the law to make use of crypto tax-loss harvesting to offset capital gains with capital losses. But in this scenario Fund B lost 33000. In short you can sell Security A at a loss to offset the capital gains tax liability on Security B and lower your personal taxesif the sales meet certain conditions.

They can also offset up to 3000 of ordinary income each taxable year. When it comes to tax-loss harvesting the big concern is the wash sale rule. Called the wash-sale rule a loss will be disallowed if the same assetsecurity is sold for a.

The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax benefit. View details map and photos of this single family property with 4 bedrooms and 3 total baths. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder security for 30 days.

The IRS wash sale rule in the US. The wash-sale rule is an IRS regulation that prohibits investors from using a capital loss for tax-loss harvesting if the identical security a. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income.

Even with the wash sale rule you can still utilize a tax-loss harvesting strategy with securities to lower your taxable capital gains. This Single Family House is 3-bed 2-bath -Sqft listed at 549000. Otherwise its considered an unrealized loss and therefore is illegal.

A wash sale involving an IRA401 k account is particularly unfavorable. You cannot sell a security at a loss and repurchase a similar investment within a 30-day period. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss.

Lets say I still realized a profit of 30000 from Fund A. Investors can offset up to 3000 per year and losses can be kept in perpetuity. Tax-loss harvesting cannot restore losses but it can mitigate them.

Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction. Therefore the tax basis of the Beta shares you acquire on December 19 2021 increases to 20200 12200 cost plus 8000 disallowed wash sale loss. Wash sale rule considerations.

For Sale - 27 Harvest Ln Commack NY. Instead the disallowed loss increases the tax basis of the substantially identical securities.

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire

Year Round Tax Loss Harvesting Benefits Onebite

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

What Is Tax Loss Harvesting Ticker Tape

Do S And Don Ts Of Tax Loss Harvesting Zoe

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Wash Sales Seeking Alpha

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Flowchart Bogleheads Org

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

How To Avoid Violating Wash Sale Rules When Realizing Tax Losses