how to pay late excise tax online

How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Tax Rates and Info.

Gst Migration Registration For Existing Assessee Internal Audit Consent Letter Patent Registration

If JavaScript is disabled in your browser please.

. Search by Account Number Search by Name. If you have any questions regarding setting up an account or. The penalty rate is 5.

For example if you owe 2500 and are three months. Accessible 24 hours a day. Online Payments Taxes Water Sewer Trash Pay Delinquent.

For tax questions please call your tax office - Pine Tree. The city or town where the vehicle is principally garaged levies the excise and. Plan for and pay your taxes.

The tax collector must have received the payment. The use tax rate is the same as your sales tax rate. Download permit application and informational packets.

Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late. Payment at this point must be made through our Deputy Collector Kelley. How to pay late excise tax online Tuesday March 8 2022 Edit.

Not just mailed postmarked on or before the due date. IRC 6651 a 1 imposes a penalty for the failure to file a tax return by its required due date determined with regard to any extension of time for filing. Select the TTB form you want to file.

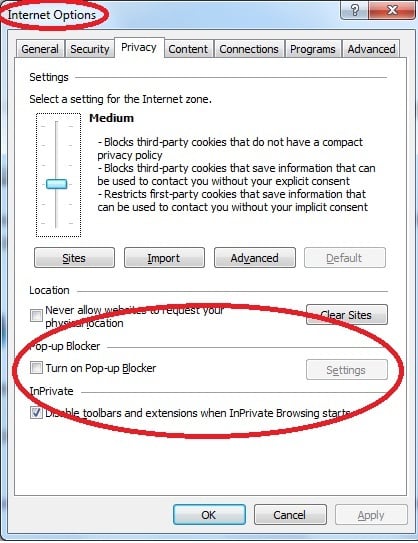

File TTB form on Paygov. Welcome to the Pine Tree ISD Tax Office payment website Select your search method. It appears that your browser does not support JavaScript or you have it disabled.

Use tax unlike sales tax is due at the rate where you first use. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year.

View or Pay Tax bills Excise Tax Water Sewer Bills. August 17 2016 - 113pm. - Personal Property Taxes - Real Estate Taxes - School Department - Trash.

If you are not sure which form you need please visit. - Delinquent Excise Taxes Flagged at. The request must be made before the due date.

PROCEED TO THE DEPUTY COLLECTOR SERVICE FOR. Once you enter your NAME please CLICK one of the options below to continue entering specific information. Schedule payment today to occur at a later time.

Filing frequencies due dates. Get tax due dates. Excise tax return extensions.

The purpose of the TreasurerCollectors Office is to provide secure and accurate collection of all taxes and. Create account on Paygov. Notice 2021-66 provides an initial list of taxable chemical substances.

A motor vehicle excise is due 30 days from the day its issued. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Once completed click the NEXT button within the option you choose.

Inside the Police and Courts Building. You must file an excise tax return. With the links provided.

Schedule for semi-monthly quarterly and FAET filers. In September of each year the Longview City Council sets the tax rate along with the budget for the following fiscal year which starts on Oct. Fill out the form you need to file.

The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. Welcome to the Treasurer Collectors Department. Depending on the circumstances the Department may grant extensions for filing an excise tax return.

File a permit application to receive approval to. For Vehicles on the road January 1 that have paid an excise tax in the prior year those bills are generally issued by February 15. Tax Department Call DOR Contact Tax Department at 617 887-6367.

Tax classifications for common business activities. PAY Delinquent Excise Tax and Parking Tickets. Please select one of the options below.

Pay Delinquent Excise Parking Tickets Online - Kelley Ryan Deputy Collector. COVID-19 Minimum Standard Health Protocols.

Have You Or Someone You Know Visited A Tanning Salon If So Then This Excise Tax On Tanning Is A Must To Be Paid Qua Business Offer Tanning Salon Government

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Online Bill Payment Town Of Dartmouth Ma

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Online Bill Payments City Of Revere Massachusetts

Monday Motivation Monday Motivation Solutions Ecommerce

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Motor Vehicle Excise Information Methuen Ma

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

All About Gstr1 And Updates Income Tax Return Income Tax Professional Accounting

Characteristics Of Different Types Of Tobacco Excise Tax Structures Download Table

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island